Diving In: State of Social & Beyond: Video Game Industry

The State of Gaming on Social: Why 2024 Marked a Major Reset for Video Game Marketing

The video game industry in 2024 stood at a powerful inflection point. Globally, the industry generated a staggering $184.3 billion, showing a slight but telling 0.2% year-over-year increase, according to GamesIndustry.biz. That kind of steady growth amid a rapidly shifting digital and economic landscape signals one thing: the market is maturing. And with maturity comes the need for smarter, more strategic engagement—especially on social.

With over 190 million Americans playing video games weekly (ESA), and 95% of game purchases now happening digitally (GamesIndustry.biz), reaching players online is no longer just one tactic among many—it’s the entire playing field.

To thrive in this new era, brands must align their marketing strategies not only with player behavior and platform trends but also with evolving community values and content preferences. Three reports—ListenFirst’s 2024 State of Social: Video Game Industry, ESA’s 2024 Essential Facts, and GamesIndustry.biz’s Year in Numbers—lay out the data brands need to adapt and lead.

The Players Have Changed. The Way We Reach Them Must, Too.

Gamers aren’t who they used to be. Today’s average player is 36 years old and has been gaming for nearly 17 years (ESA). They’re not just teenagers in basements anymore—they’re professionals, parents, partners, and highly engaged digital consumers. In fact:

- 83% of parents say they play games with their children.

- 74% of players game with others, either online or in person.

- 53% say gaming has helped them make lasting memories.

- 39% report meeting a close friend or partner through games.

Gaming is now one of the most powerful cultural connectors—something not lost on marketers. And yet, many brands still rely on outdated strategies that don’t reflect the emotional and social depth of modern gaming communities.

TikTok and Instagram Are the New Frontlines

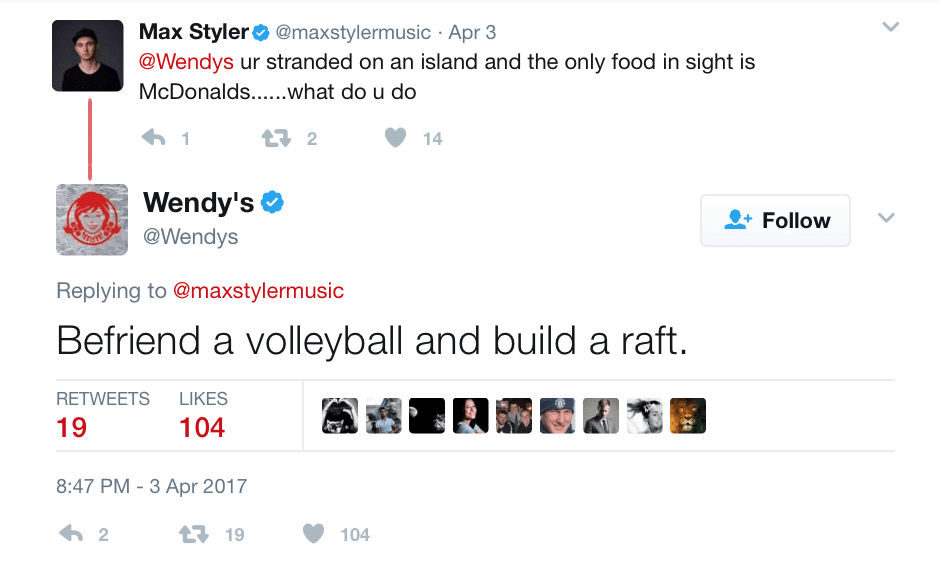

On the surface, X may seem like the heart of gaming chatter—it had the highest post volume from publishers in 2024 (ListenFirst). But dig into the data, and its influence is clearly waning:

- X saw a -18% YoY decline across all major metrics.

- Engagements and views dropped sharply despite high content output.

Meanwhile, TikTok and Instagram emerged as powerhouses:

- TikTok: Only platform to grow across engagements (+16%), video views, and response rate (0.92%). It also boasted the highest average video response rate at 15.7%.

- Instagram: Led in total engagements, with spikes tied to major events like Gamescom. It had the second-highest response rate at 0.39%.

Activision Blizzard, for example, reduced its TikTok post volume by 71%, yet saw a +117% spike in engagements and +75% follower growth on the platform. Meanwhile, its X performance plummeted across every key metric.

These results reflect a bigger truth: audiences are migrating, and marketers need to follow them. TikTok’s short-form video content and participatory culture offer unique, high-impact ways to connect with gaming communities—especially younger ones.

Video Reigns Supreme Across Platforms

It’s no surprise that video content dominated in 2024. According to ListenFirst, video accounted for +82% of total content volume and led in both engagement and response rate across every major platform. TikTok and YouTube drove the highest monthly video views, with viewership peaking in June, likely timed to coincide with major gaming reveals and trailers.

From teaser drops to behind-the-scenes development clips, audiences aren’t just watching—they’re responding. On TikTok, the average response rate for video posts was over 15%, signaling just how powerful native, short-form video can be in driving real-time interaction.

Yet despite the format’s success, not every platform can keep up. Facebook and Twitter struggled to deliver competitive video engagement or meaningful growth. Even brands with high post volumes on these channels saw underwhelming results unless they diversified and optimized content format.

More Posts ≠ More Fans

One of the most critical insights from ListenFirst’s report is a wake-up call for overactive content teams: posting more does not mean gaining more followers.

In fact:

- Brands that posted 10% above the industry average experienced user fatigue and declining engagement.

- Those who kept post volume within 5% of the industry norm saw higher viewership and more sustained interaction.

- Post volume had zero correlation to fan growth.

This supports a shift in mindset from quantity to quality. It’s not about how often you show up—it’s how intentional your content is when you do.

Mobile Gaming Leads in Both Play and Profit

From a revenue perspective, mobile gaming dominated 2024. Per GamesIndustry.biz:

- Mobile accounted for $92.5 billion in revenue—50% of the global total.

- It was the only segment to grow (+2.8%), while console and PC revenue dipped.

- The top mobile game? MONOPOLY GO!, earning $2.47 billion, ahead of Candy Crush and Roblox.

This aligns with the ESA’s report, which found that 78% of gamers play on mobile, a massive jump from just 33% a decade ago. Mobile is no longer just an “entry-level” platform—it’s where the most diverse, engaged, and accessible audiences live.

Games Are Emotional, Social, and Human

If there’s one thing all three reports agree on, it’s this: gaming is no longer just about play—it’s about connection.

- 72% of players believe games build community (ESA).

- 73% say games introduce them to new people.

- 67% play for fun. 68% play to relax or relieve stress.

- Across generations, players consistently cite games as sources of joy, cognitive stimulation, and emotional support.

This emotional dimension fuels the most successful social content. Brands like PlayStation leaned into nostalgia and fandom with Helldivers 2 and PS5 Pro promotions, becoming 2024’s top publisher in total followers and engagements—even with a reduced posting volume.

It’s no longer enough to announce a release date. Today’s audiences expect content that sparks joy, builds relationships, and feels like it was made for them.

So What’s Next?

The U.S. gaming industry contributed nearly $66 billion to GDP and supported more than $101 billion in total economic impact in 2023. And with Gen Alpha emerging as the next wave of players—and creators—the stakes are only getting higher.

To stay ahead, marketers must:

- Lean into video-first strategies, especially on TikTok and YouTube.

- Embrace mobile as a primary engagement platform, not a secondary one.

- Optimize content volume for sustainability and audience receptivity.

- Prioritize emotional storytelling and community engagement over announcements and updates.

In short, treat social not as a megaphone—but as a gaming console in itself: an interactive, dynamic space where stories unfold, identities are formed, and relationships thrive.

📥 Want to go deeper?

Download the full 2024 State of Social: Video Game Industry report for detailed platform-by-platform insights, top publisher strategies, and creative trends shaping the future of video game marketing.

Want more deep dives like this? Make sure to subscribe to our weekly newsletter, LF Pool Party, for everything social media professionals need to know to make their strategy a 10/10.